If you’re a freelancer or a student looking for a hassle-free way to manage your finances and receive payments, then you might want to consider opening an MCB Freelancer account online.

MCB Bank is one of the largest banks in Pakistan, and its Freelancer account is specifically designed to cater to the needs of freelancers and students. With this account, you can enjoy a range of benefits, including zero account opening charges, free online banking, and 24/7 customer support.

Moreover, you can receive payments from clients all around the world through multiple payment gateways. So, whether you’re a freelance writer, graphic designer, or student entrepreneur, opening an MCB Freelancer account online could be the perfect solution for you.

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

MCB Freelancer Account Opening Online

Table of Contents

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

Eligibility Criteria

To be eligible for opening an MCB account online, you need to meet certain criteria set by MCB Bank.

- Age: You must be at least 18 years old to open an MCB account.

- Profession: This account is specifically designed for freelancers and students who are looking for a dedicated account to manage their finances and receive payments.

- Documents: You need to have the necessary documents to complete the account opening process. These documents may include your CNIC, passport, or any other government-issued ID, as well as proof of your freelance or student status.

- Residence: You should be a resident of Pakistan to open an MCB Freelancer account.

- Valid email address and mobile number: You must have a valid email address and mobile number to receive important updates and notifications related to your account.

Recommended Reading: HBL Freelancer Account Opening Online (Islamic Banking) {Updated}

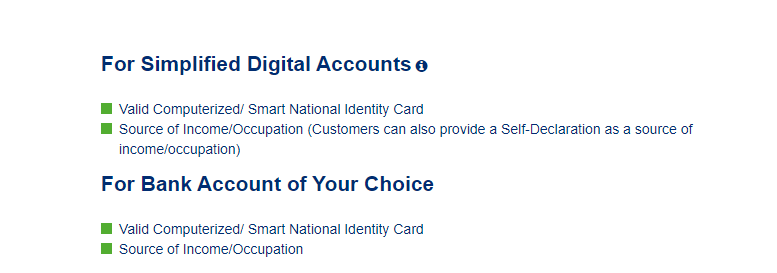

Documents Required

To open an MCB account online, you need to provide certain documents as part of the account opening process. These documents typically include:

| Required Documents | Details |

|---|---|

| CNIC: | Your Computerized National Identity Card serves as the primary form of identification for MCB Bank. |

| Proof of Profession: | Provide evidence of your professional status as a freelancer or student, such as a business card or letter from your educational institution. |

| Passport: | If you don’t have a CNIC, you can use your passport as an alternative form of identification. |

| Proof of Residence: | Submit documentation like a utility bill or bank statement to confirm your address in Pakistan. |

| Photograph: | A recent passport-sized photograph may be required for identification purposes. |

Recommended Reading: Free! Standard Chartered Freelancer Account | SC Digital Account

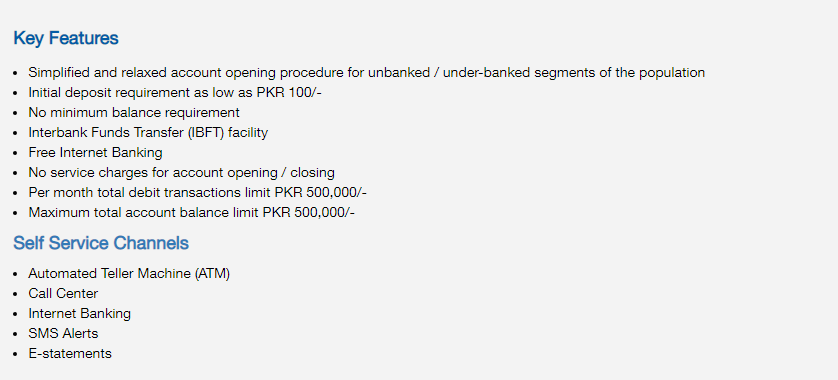

MCB Freelancer Account Key Features

The MCB account comes with a range of key features that make it an attractive option for freelancers and students.

Some of the most notable features of this account include:

| Features | Details |

|---|---|

| Simplified Account Opening Procedure: | Easy process tailored for unbanked/under-banked individuals, with initial deposit requirement as low as PKR 100/-. |

| No Minimum Balance Requirement: | Enjoy the freedom of maintaining any balance without worrying about minimum requirements. |

| Interbank Funds Transfer: | Transfer funds between banks hassle-free, providing convenient banking solutions. |

| Free Internet Banking: | Access your account anytime, anywhere without any additional charges. |

| No Service Charges: | No fees for opening or closing your account, ensuring cost-effective banking. |

| Monthly Debit Transaction Limit: | Total debit transactions are limited to PKR 500,000 per month. |

| Maximum Account Balance Limit: | Maximum account balance capped at PKR 500,000, providing a safe and secure banking experience. |

| Self Service Channels: | Access your account through various self-service channels such as ATM, Call Center, Internet Banking, SMS Alerts, and E-statements. |

Recommended Reading: Free! How To Open Meezan Bank Freelancer Account {Ultimate Guide}

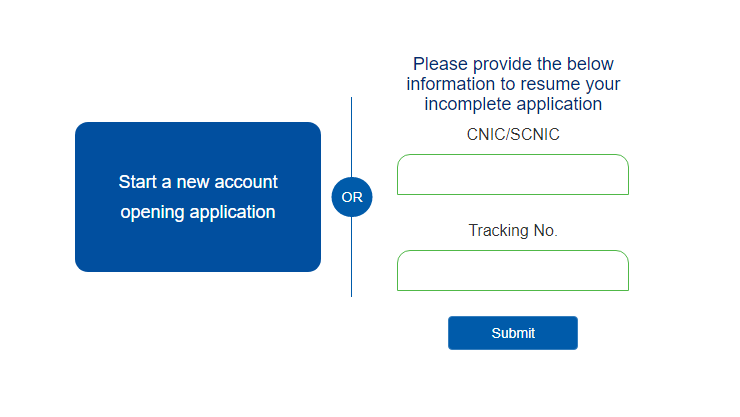

How To Open MCB Freelancer Account Online Step-By-Step

Opening an MCB Freelancer account online is a simple process that can be completed in a few easy steps.

Here’s a step-by-step guide on how to open an MCB Freelancer account online using the MCB website:

| Steps to Open MCB Freelancer Account | Steps to Open an MCB Freelancer Account |

|---|---|

| Visit MCB App or Website: | Go to the MCB App or https://eaccount.mcb.com.pk/apply_products.jsp to access the MCB website. |

| Select Freelancer Account: | Choose the Freelancer account option from the available products list. |

| Click “Apply Now”: | Initiate the account opening process by clicking on the “Apply Now” button. |

| Fill Application Form: | Provide personal details such as name, email, CNIC/passport number, and professional information in the form. |

| Upload Required Documents: | Upload necessary documents like a CNIC/passport, proof of profession, proof of residence, and a passport-sized photo. |

| Review and Submit: | Double-check your application for accuracy and completeness before clicking “Submit”. |

| Wait for Verification: | MCB Bank will review your application and documents, which may take a few days. |

| Receive Account Details: | Upon approval, MCB Bank will email your account details, including your account number and login credentials. |

| Activate Account: | Log in using the provided credentials and follow the instructions to activate your account. |

| Start Using Your Account: | Once activated, access your MCB Freelancer account online to manage finances, receive payments, and more. |

That’s it! By following these steps, you can easily open an MCB account online and enjoy the numerous benefits it offers.

Recommended Reading: Top 5 Best Bank Account For Freelancers In Pakistan {Tried+Tested}

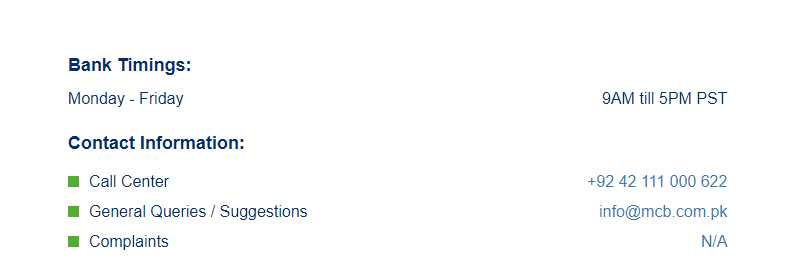

MCB Helpline Number

MCB helpline number is +92 42 111 000 622 and the email address for general information is info@mcb.com.pk.

Customers can contact MCB Bank through these channels for any queries, complaints, or assistance regarding their banking services or MCB Account.

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

MCB Freelancer Account Pros And Cons

MCB Freelancer Account is a specialized banking solution designed to cater to the unique financial needs of freelancers and students.

As with any financial product, there are certain pros and cons associated with this account. Let’s take a look at some of the key advantages and disadvantages of an MCB Account:

Pros Of MCB Freelancer Account

- Zero account opening charges: MCB Bank offers free account opening for Freelancer accounts.

- Free online banking: This account offers free online banking, allowing you to access your account information and perform a variety of banking transactions online without any additional charges.

- Multiple payment gateways: You can receive payments from clients all around the world via multiple payment gateways.

- High transaction limits: The MCB Freelancer account has a high daily transaction limit, allowing you to make larger transactions and withdrawals compared to other types of accounts.

- Dedicated customer support: MCB Bank provides dedicated customer support to its Freelancer account holders.

Cons Of MCB Freelancer Account

- Limited eligibility: This account is only available to freelancers and students, which means that it may not be suitable for everyone.

- Limited physical presence: MCB Bank has a limited physical presence in some areas.

- No interest earnings: MCB Freelancer account does not offer any interest on account balances, which may be a disadvantage for some account holders.

- Limited access to other banking products: MCB Digital account is a specialized banking product and may not provide access to the full range of banking products and services offered by MCB Bank.

- Limited international reach: While the MCB Freelancer account does offer multiple payment gateways.

Recommended Reading: List Of Online Loan Apps That Are Scamming People In Pakistan {Updated}

MCB Freelancer Account FAQs

What is an MCB Freelancer Account?

MCB Freelancer Account is a specialized banking solution designed to cater to the unique financial needs of freelancers and students. It offers features such as free online banking, multiple payment gateways, and high transaction limits.

Who is eligible for an MCB Freelancer Account?

Freelancers and students are eligible for an MCB Freelancer Account. Freelancers must have a valid CNIC and proof of their freelance work, while students must provide proof of enrollment in a recognized educational institution.

How can I open an MCB Freelancer Account?

You can open an MCB Freelancer Account online by visiting the MCB Bank website and filling out the online application form. You will need to provide personal information and documents to confirm your status as a freelancer or student.

Is there a fee to open an MCB Freelancer Account?

No, there are no account opening charges for the MCB Freelancer Account.

Does the MCB Freelancer Account offer interest on balances?

No, the MCB Freelancer Account does not offer any interest on account balances.

Can I access my MCB Freelancer Account online?

Yes, you can access your MCB Freelancer Account online through the MCB Bank website or mobile app.

What is the daily transaction limit for MCB Freelancer Account?

The daily transaction limit for MCB Freelancer Account is higher than other types of accounts, allowing you to make larger transactions and withdrawals.

What payment gateways are supported by the MCB Freelancer Account?

MCB Freelancer Account supports multiple payment gateways, including PayPal, Skrill, and Payoneer.

What customer support is available for MCB Freelancer Account holders?

MCB Bank provides dedicated customer support to its Freelancer account holders, ensuring that you receive timely assistance whenever you need it.

Can I access other banking products and services with the MCB Freelancer Account?

MCB Freelancer Account is a specialized banking product and may not provide access to the full range of banking products and services offered by MCB Bank.

Recommended Reading: Bank Of Punjab Freelancer Account | BOP Account Opening Online

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment