In today’s fast-paced and increasingly digital world, more and more people are turning to freelance work to earn a living.

As the gig economy grows, managing finances and staying on top of taxes can be daunting for many freelancers.

Standard Chartered has recognized this need and launched its Standard Chartered Freelancer Account, which offers a range of benefits and features to make financial management easier for freelancers.

With this account, freelancers can focus on their work and leave the hassle of banking and taxes to the experts at Standard Chartered.

In this article, we will explore legibility criteria, benefits, the online accounts opening process, and all the relevant details of the Standard Chartered Freelance Account. So, let’s get started!

Recommended Reading: Free! How To Open Meezan Bank Freelancer Account {Ultimate Guide}

Standard Chartered Freelancer Account | Standard Chartered Digital Account

Table of Contents

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

Benefits Of Standard Chartered Freelancer Account

The Standard Chartered Freelancer Account offers numerous benefits to its users, including:

- Instant and hassle-free account opening, which can be done anytime and anywhere, saving valuable time and effort.

- Greater convenience and flexibility for receiving payments from clients, as the account is specifically designed for freelancers and offers tailored solutions for managing payments and finances.

- Zero account maintenance fees, which means that freelancers can save money on banking costs and invest their hard-earned income elsewhere.

Recommended Reading: Top 5 Best Bank Accounts For Freelancers In Pakistan {Tried+Tested}

Standard Chartered Freelancer Account Key Features

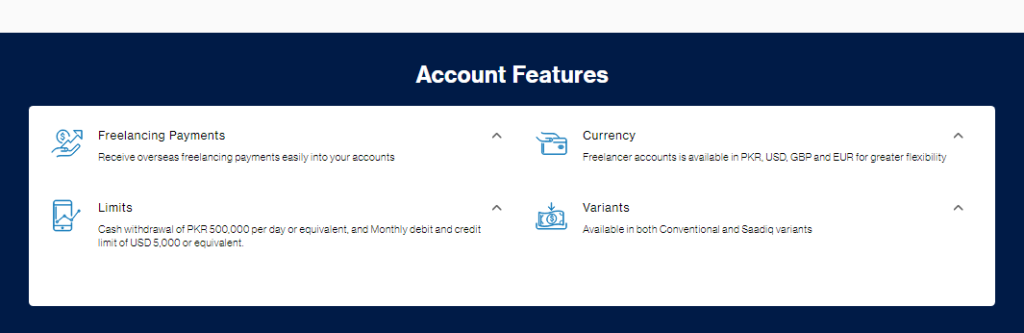

The Standard Chartered Freelancer Account offers a range of key features to meet the unique needs of freelancers, including:

| Account Features | Details |

|---|---|

| Freelancing Payments: | Easily receive overseas freelancing payments directly into your account. |

| Currency: | Freelancer accounts are available in PKR, USD, GBP, and EUR, providing greater flexibility. |

| Limits: | Cash withdrawal limit of PKR 500,000 per day or equivalent, with a monthly debit and credit limit of USD 5,000. |

| Variants: | Available in both Conventional and Seediq variants, catering to different banking preferences. |

Recommended Reading: List Of Online Loan Apps That Are Scamming People In Pakistan {Updated}

Eligibility Criteria

To be eligible for the Standard Chartered Freelancer Account, the following criteria must be met:

- The applicant must be a Pakistani citizen.

- The minimum age requirement for opening an account is 18 years and above.

- The applicant must provide valid proof of identification and address verification as per the bank’s requirements.

- The applicant must provide evidence of their freelancing income or work experience, as specified by the bank.

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

Documents Required

To open a Standard Chartered Freelancer Account, the applicant will need to provide the following documents:

| Required Documents | Details |

|---|---|

| Valid and Registered Mobile Number: | The applicant must have a mobile number that is both valid and registered in their name. |

| National Identity Card (NIC/SNIC): | An NIC or SNIC issued by NADRA is necessary for identity verification. |

| Supporting Documents (Optional): | Additional documents may be required by the bank, such as proof of income or address verification, based on their specific criteria. |

Recommended Reading: Top 3 Loan Apps In Pakistan (5K-50K Urgent Cash) {Interest-free}

How To Open Standard Chartered Freelancer Account Online

Opening a Standard Chartered Freelancer Account online is an easy process that can be completed in just a few simple steps.

Here’s how to open a Freelancer Account with Standard Chartered online:

| Steps | Details |

|---|---|

| Download the Standard Chartered Mobile App: | Install the app from the Standard Chartered Mobile App Store or Google Play Store onto your mobile device. |

| Select Account Type: | Choose the Standard Chartered Freelancer Account/Digital Account and provide NADRA consent. |

| Enter Contact Details: | Input your mobile number, email address, etc., and verify your identity using the OTP sent to your mobile number. |

| Scan CNIC: | Use your mobile device’s camera to scan your CNIC for identification purposes. |

| Review Information: | Double-check the entered personal and contact details for accuracy. |

| Take Selfie: | Capture a selfie to be used as your account picture and undergo biometric verification. |

| Enter Employment Details: | Provide details about your freelancing work and income for employment verification. |

| Select Debit Card Type: | Choose the type of debit card you prefer to receive with your Freelancer Account. |

| Review and Confirm: | Verify all entered information to ensure accuracy before clicking “Done” to finalize the account opening process. |

Recommended Reading: Bank Of Punjab Freelancer Account | BOP Account Opening Online

Standard Chartered Helpline Number

Here are the contact details for Standard Chartered:

- Website: https://www.sc.com/pk

- Customer service helpline: 111 002 002

- Email: customer.care@sc.com

- Branch locator: https://www.sc.com/pk/branch-locator/

- Facebook page: https://www.facebook.com/StandardCharteredPK/

- Twitter handle: https://twitter.com/StanChartPK

Recommended Reading: Online Loan In Pakistan Without Interest {10K-5Lakh} (Personal+Business)

Difference Between HBL And Standard Chartered Freelancer Account

Sure, here’s a simplified comparison table between Standard Chartered and HBL Freelancer Account:

| Features | Standard Chartered Freelancer Account | HBL Freelancer Account |

|---|---|---|

| Eligibility: | Available to Pakistani nationals aged 18 and above. | Open to individuals of 18 years and above. |

| Documents Required: | Valid NIC or SNIC, registered mobile number. | Valid CNIC. |

| Account Opening Process: | Online process with easy steps. | Online process with minimal documentation. |

| Currency Options: | PKR, USD, GBP, EUR. | PKR, USD, GBP, EUR. |

| Transaction Limits: | Generous withdrawal and transaction limits. | Monthly transaction limit of USD 5,000. |

| Additional Benefits: | Dedicated relationship manager, banking solutions. | Low transaction fees, multiple account options. |

| Branch Network: | Limited branch network in Pakistan. | Extensive branch network across Pakistan. |

| Account Maintenance Fees: | No account maintenance fees. | Not specified. |

| Availability of Islamic Variant: | Not specified. | Available in both Conventional and Islamic variants. |

| Special Features: | Personalized support, currency flexibility. | Convenient account opening, low transaction fees. |

Standard Chartered Freelancer Account Pros And Cons

Here are some pros and cons of the Standard Chartered Freelancer Account:

| Pros | Cons |

|---|---|

| Easy account opening process: | Limited branch network: May not be convenient for all customers. |

| banking solutions: | Limited availability of Saadiq variant: Not available in all areas. |

| Currency Change: | Limited features: Some users may find it lacking certain options. |

| Max transaction limits: | Account maintenance fees: Other transactions may incur charges. |

| Dedicated relationship manager: | Eligibility criteria: Limited to Pakistani nationals aged 18 and above. |

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

FAQs | Standard Chartered Freelancer Account

What is a Standard Chartered Freelancer Account?

A Standard Chartered Freelancer Account is a bank account designed specifically for freelancers, offering tailored solutions to manage payments and finances more effectively.

What are the eligibility criteria for opening a Standard Chartered Freelancer Account?

To open a Standard Chartered Freelancer Account, you must be a Pakistani national aged 18 or above and have a valid National Identity Card (SNIC & CNIC).

Can I open a Standard Chartered Freelancer Account online?

Yes, you can open a Standard Chartered Freelancer Account online through the Standard Chartered mobile app.

What currencies are available with the Standard Chartered Freelancer Account?

The Freelancer Account is available in PKR, USD, GBP, and EUR, providing currency flexibility for freelancers.

What are the transaction limits with the Standard Chartered Freelancer Account?

The account offers a cash withdrawal limit of PKR 500,000 per day or equivalent and a monthly debit and credit limit of USD 5,000 or equivalent.

Does the Standard Chartered Freelancer Account have any account maintenance fees?

The Freelancer Account has no account maintenance fees, but other banking transactions may incur charges.

Can I link my Freelancer Account to other banking services, such as PayPal?

Yes, you can link your Freelancer Account to other banking services, including PayPal, to manage your finances more effectively.

What documents do I need to open a Standard Chartered Freelancer Account?

You will need a registered mobile number and a valid National Identity Card (SNIC & CNIC) to open a Standard Chartered Freelancer Account.

Can I use my Standard Chartered Freelancer Account for personal transactions?

While the Freelancer Account is primarily designed for freelancers to manage their payments and finances, you can also use it for personal transactions.

Can I transfer funds between my Standard Chartered Freelancer Account and other bank accounts?

Yes, you can transfer funds between your Freelancer Account and other bank accounts using the Standard Chartered mobile app or online banking platform.

How long does it take to open a Standard Chartered Freelancer Account?

The account opening process can be completed online in just a few minutes, and your account will be activated within 24 hours.

Are there different variants of the Standard Chartered Freelancer Account?

Yes, the account is available in both Conventional and Saadiq variants.

The Conventional variant caters to those who prefer conventional banking products and services, while the Saadiq variant aligns with Islamic banking principles.

Is the Standard Chartered Freelancer Account available in all locations?

The availability of the account may vary depending on your location.

It is advisable to check with Standard Chartered directly or refer to their official documentation to determine if the Freelancer Account is available in your specific region.

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment